Oil prices rose to reach levels above $72 a barrel, recovering from a five-year low reached last week. After a surprising decision from the Organization of Petroleum Exporting Countries (OPEC) to not cut production despite a global excess of supply, investors have been looking for a new price floor. Oil lost more than 12 percent since OPEC's decision last Thursday.

U.S. crude and Brent have also been falling over a wider period of time (five months in a row) marking oil's longest downward streak since 2008.

Brent hit a low of $67.53 a barrel, the lowest since October 2009, before rising to $72.98 a barrel Monday.

According to Reuters, "The market is still very much in panic mode," said Energy Aspects' chief oil analyst Amrita Sen. "Once we get over the panic, Brent prices will probably stabilise at around $65-80 a barrel in the short term."

"We can expect such volatility in the near future given the market had overshot to the downside," Sen said.

The supply growth has been mainly fueled by America's shale oil revolution, though other projects worldwide have also contributed to production growth. Many of these projects were launched with high-oil prices in mind, so the important shakeout happening will have different impacts depending on producers' operating costs per barrel.

Bloomberg says Russia, the world's largest producer, can no longer rely on the same oil revenues to rescue an economy suffering from European and U.S. sanctions. Iran, also reeling from similar sanctions, will need to reduce subsidies that have partly insulated its growing population. Nigeria, fighting an Islamic insurgency, and Venezuela, crippled by failing political and economic policies, also rank among the biggest losers from the OPEC decision last week to let the force of the market determine what some experts say will be the first free-fall in decades.

Oil has dropped 37 percent this year and, in theory, production can continue to flow until prices fall below the day-to-day costs at existing wells. Stevens said some U.S. shale producers may break even at $40 a barrel or less. The International Energy Agency estimates most drilling in the Bakken formation -- the shale producers that OPEC seeks to drive out of business -- return cash at $42 a barrel.

"Right now we're seeing a price shock coming out of the meeting and it will be a couple of weeks until we see where the price really falls," said Yergin. Officials "have to figure out where the new price range is, and that's the drama that's going to play out in the weeks ahead."

To be sure, not all oil producers are suffering. The International Monetary Fund in October assessed the oil price different governments needed to balance their budgets. At one end were Kuwait, Qatar and the United Arab Emirates, which can break even with oil at about $70 a barrel. At the other extreme: Iran needs $136, and Venezuela and Nigeria $120. Russia can manage at $101 a barrel, the IMF said.

Only time will tell if today's rebound marks the reaching of a new price floor, or if it is merely a temporary stop on the way further down.

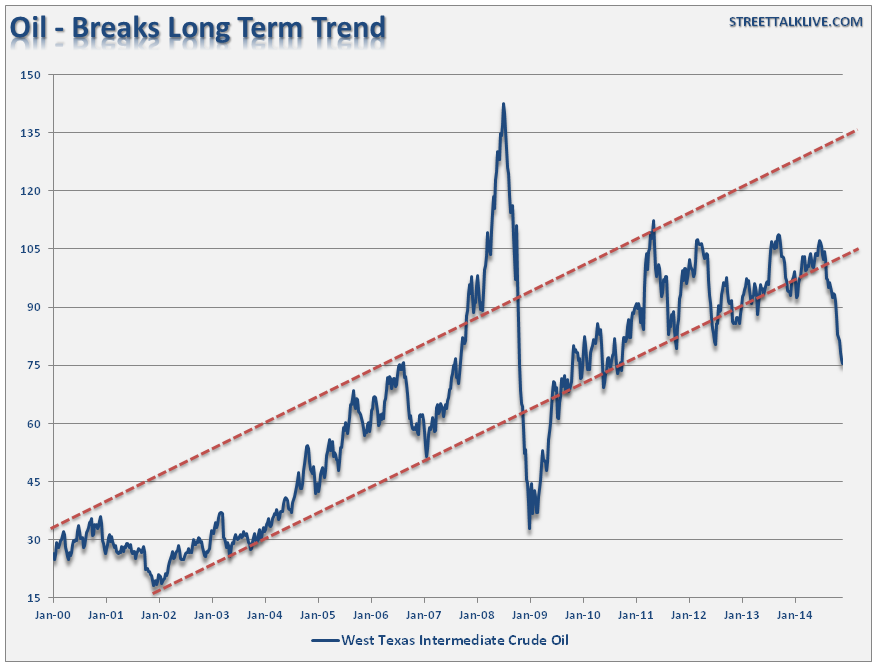

For some further reading that some technical traders are reading this week: http://www.zerohedge.com/news/2014-12-01/oil-price-decline-pictures