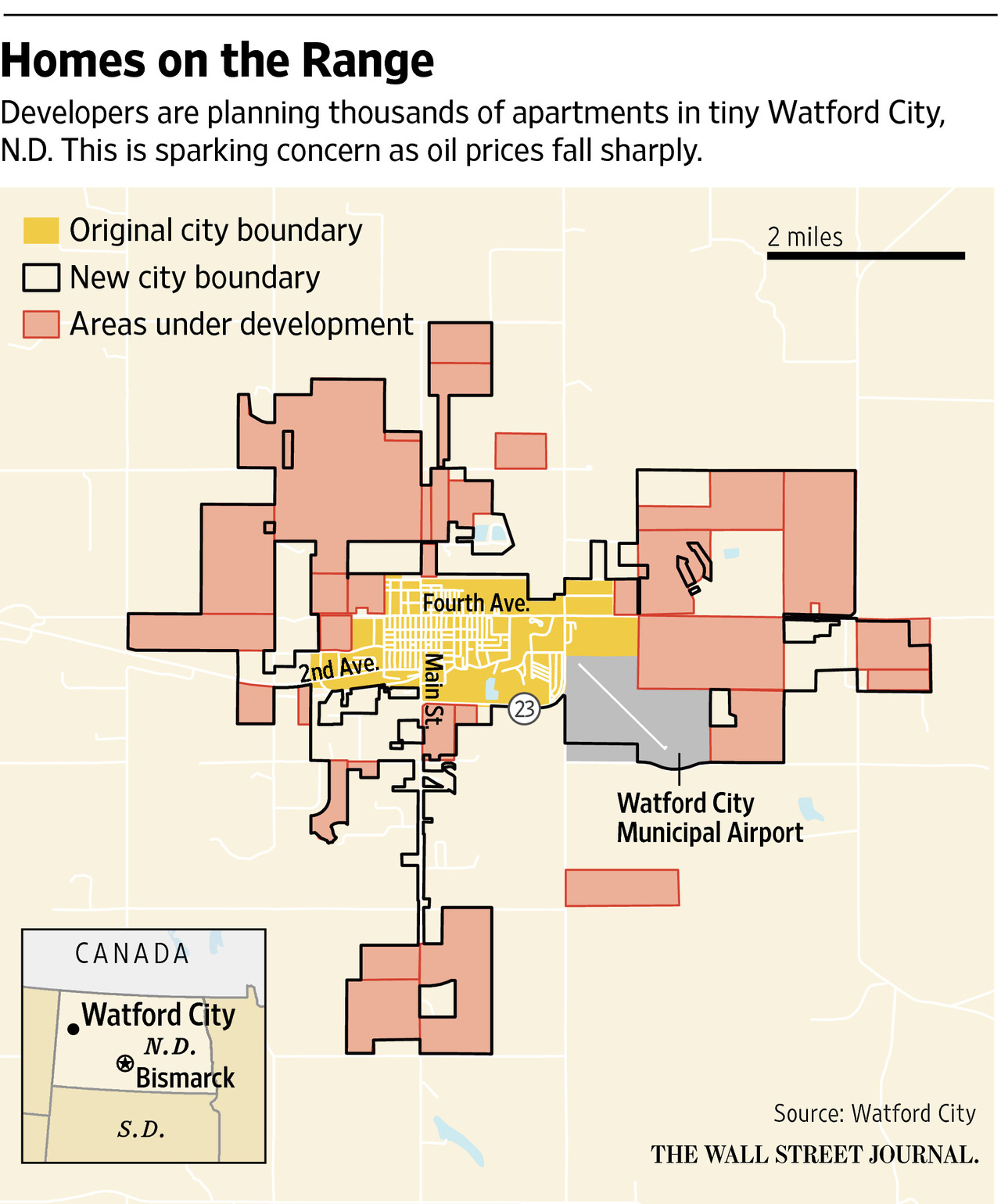

Oil boomtown, Watford City,ND is now developing with caution.

Watford City is known for turing it's wheat fields into a shale oil production city. Within five years this small town quadrupled, which brought in housing developers. However, with crude prices dropping from $100 in June to $60 this past Tuesday, caution is now being taken.

Eliot Brown from the Wall Street Journal writes in depth about this subject. Below is his article;

But with crude prices less than half of what they were nine months ago, land-rush euphoria is giving way to concerns that projects will stall and Manhattan-level apartment rents could plunge as drillers cut production and jobs.

“A person would have to be somewhat blind to not be worried,” said Kent Roers, a Minneapolis-based investor who came to the area three years ago, and with his younger brother Brian has built 200 apartments in Watford City. The brothers were readying three more projects, but “as soon as oil pulled through $60 a barrel, we shelved those.”

For now, Watford City and other once-tiny towns in this region of western North Dakota are still humming with construction. Developers are building thousands of apartment units and homes, hoping to see the same demand that sent rents for two-bedroom apartments soaring to $2,800 a month—more than double what landlords got before a type of oil extraction known as hydraulic fracturing, or fracking, took off in the area starting around 2009.

For now, Watford City and other once-tiny towns in this region of western North Dakota are still humming with construction. Developers are building thousands of apartment units and homes, hoping to see the same demand that sent rents for two-bedroom apartments soaring to $2,800 a month—more than double what landlords got before a type of oil extraction known as hydraulic fracturing, or fracking, took off in the area starting around 2009.

City officials expect about 1,000 housing units to be completed this year, more than enough to house all the city’s residents before the oil boom. Thousands more are planned.

If the regional economy tumbles, the developers that could be hurt are mainly small and midsized investors. One exception: private-equity giant KKR Co. The company is in the midst of building a $150 million cluster of apartments and homes about 50 miles away on a hillside in Williston called Prairie Pines. A KKR spokeswoman said the company is “monitoring the situation.”

Already, the oil industry has started cutting back. The count of drill rigs in the state has fallen to 110 from 191 a year ago, and state officials expect it to decline further. Employers are cutting hours, and while unemployment is still low, drilling companies have said they expect to slash expenses this year.

Banks already are beginning to pull back on financing for local development projects, fearful of how the oil plunge will play out.

First Bank of Baldwin is a small Wisconsin bank that holds more than $8 million in debt on four projects in Williston and in nearby Tioga and Dickinson. Shane Bauer,the bank’s president, said rents on some projects are running lower than expected—about $2,600 a month for an apartment in one, down from a projected $3,200, although still high enough to make debt payments.

Given current oil prices, “I wouldn’t, and we’re not, investing additional dollars out there,” Mr. Bauer said. “We just want to see things level off.”

A property bust isn’t a certainty. Oil prices could rise, and many local officials believe the companies can still drill profitably at $50 a barrel or less. Even if prices remain low, there are now permanent jobs servicing all the wells that already have been built. In addition, surrounding towns have thousands of units of “man camps,” no-frills temporary housing that could be vacated in favor of the new apartments.

Watford City’s growth has been impressive even by oil-patch standards. Officials put its population between 7,000 and 10,000, compared with a census reading of 1,764 in 2010. While smaller than Williston—which has roughly 30,000 people, double its pre-oil population—Watford is growing at a faster rate and is surrounded by more oil rigs. Its low-slung Main Street, dotted with a pharmacy, a coffee kiosk and a local bank, is dominated by pickup truck-driving oil workers, and shops offering disposable covers for boots caked with mud.

Developers were so eager to build that they would “come pull me off the combine at night,” said Curt Moen, the part-time city planner and a full-time farmer, referring to his large wheat harvester.

Vedadi Corp., a Scottsdale, Ariz., company run by Jason Vedadi, is building hundreds of apartments in Watford City. Mr. Vedadi said he bought and flipped distressed properties in the Phoenix area before former colleagues suggested he take a look at North Dakota. Now he controls 400 acres with more than 750 more units planned or under construction.

“It didn’t take long to say, wow, ’I’ve never seen anything like this,’” said Mr. Vedadi, who added that he remains bullish about the region’s growth. “You’ve got little towns turning into cities ... and returns that are crazy.”

On the western edge of town, China-based Shangcheng Development LLC is working on a 237-acre project called Emerald Ridge where it has filed plans to build up to 1,500 units in apartments and townhomes. The company didn’t respond to requests for comment.

Just north of Watford City’s downtown, New York-based Coltown Properties LLC has finished 107 units and has plans for 200 more. Steven Neuman, co-owner of the firm, said aside from the North Dakota development, the company had no projects outside New York, where it largely owns apartments. Mr. Neuman, too, said he is watching oil closely, but is confident in the town.

Some developers have already cashed out. Beryl Thorson and her husband, Gary, owned two older, low-rent apartment buildings. In recent years, Ms. Thorson said she was able to raise rents to $900 a month for two-bedroom units, up from $350 around 2010, but still well below market because she didn’t want to kick out longtime tenants. But she grew tired of maintaining the apartments, and values had soared, so the couple sold last year for a substantial profit, which they declined to disclose.

“We got a very good price,” she said.

Write to Eliot Brown at [email protected]