The economics of global manufacturing are shifting. For decades, people have been saying that manufacturing costs are cheap in regions like Eastern Europe, Latin America, and most of Asia. On the other hand, the United States, Western Europe, and Japan have been viewed as having high costs. That worldview is out-of-date according to a new report released by The Boston Consulting Group. Costs have been shifting and the competitive edge now belongs to the U.S. and Mexico. While the common narrative was still that American manufacturing was dead and done, heavy machinery manufacturer Caterpillar has been shifting production of construction equipment from Japan back to the U.S., creating hundreds of jobs.

Designed with executives of export manufacturing firms in mind, the BCG report describes how steady changes in a variety of factors, such as wages, productivity, energy costs and currency values, are redrawing the map of global manufacturing cost competitiveness. While seemingly subtle, these changes are dramatic. Some of the shifts in relative costs are actually quite surprising. A decade ago, not many people would have predicted that Brazil would now be one of the highest-cost countries for manufacturing— and that Mexico could be cheaper than China. Costs in Eastern Europe and Russia have risen to near equivalence with the U.S.

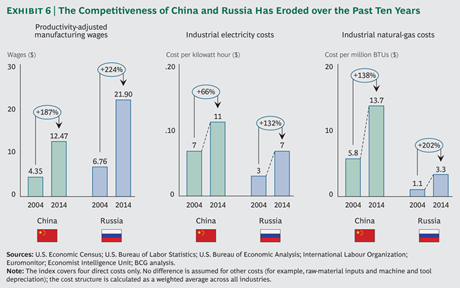

Key factors behind all these changes vary widely by economy. The BCG researchers say, "skyrocketing labor and energy costs have eroded the competitiveness of China and Russia. A decade ago, for example, manufacturing wages adjusted for productivity averaged an estimated $4.35 an hour in China and $6.76 in Russia, compared with $17.54 in the U.S. Again, adjusted for productivity differences, labor costs have roughly tripled in both countries, to an estimated $12.47 an hour in China and $21.90 in Russia. Average productivity-adjusted manufacturing labor costs in the U.S. have risen by only 27 percent since 2004, to $22.32. The cost of industrial electricity increased by an estimated 66 percent in China and 78 percent in Russia, while the cost of natural gas soared by an estimated 138 percent in China and 202 percent in Russia from 2004 to 2014."

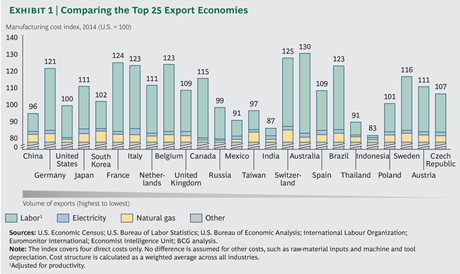

As Forbes reports on the BCG study, the U.S. has emerged as the lowest-cost manufacturing location of the developed world, roughly on par with South Korea. The manufacturing-cost gap between the U.S. and other developed countries widened significantly between 2004 and 2014. Average U.S. costs are now estimated to be 9 percentage points lower than the UK, 11 points lower than Japan, 21 points lower than Germany, and 24 points lower than France.

According to the study, the U.S. is even approached cost-parity with some nations of Eastern Europe. Our cost gap with China “has shrunk dramatically” and, BCG researchers said, “if the trend of the last ten years continues, will disappear before the end of the decade.” Labor is one key to the growing U.S. competitive advantage. The U.S. has one of the developed world’s most flexible labor markets, ranking as the most favorable economy in terms of labor regulation among the top 25 manufacturing exporters. The U.S. also has by far the highest worker productivity among the world’s 25 biggest manufactured-goods exporters. Adjusted for productivity, U.S. labor costs are an estimated 20% to 54% lower than those of Western Europe and Japan for many products.

Prices for natural gas have risen around the world, but have fallen in the U.S. by around 50% since 2005, when large-scale recovery from underground shale deposits began in earnest." Natural gas currently costs three times more in China, France, and Germany and four times more in energy strapped Japan. The energy component will be a hard one for competitors to tackle in the years ahead, BCG researchers said.

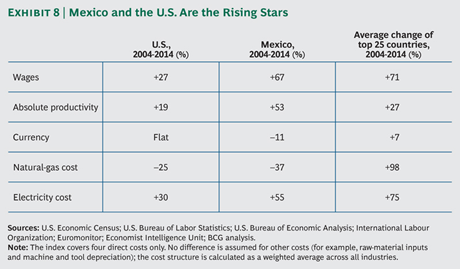

Forbes contributor Kenneth Rapoza continues by saying, "For Mexico, Latin America’s second largest economy has regained its status as a leading low-cost manufacturer, replacing China on many product lines."

In 2000, Mexican manufacturing labor was roughly twice as expensive as China’s. Since 2004, Chinese wages have risen four fold. Mexican wages also rose, but by much less in pesos and even less in dollar terms while the Chinese yuan has gotten stronger over the same period. The report said that even though China has had higher productivity growth, the average Mexican productivity-adjusted labor costs are now estimated to be 13% lower China’s. Add attractive electricity and natural-gas costs, and Mexico’s total costs are estimated to be 5% below those of China, 9% below those of the U.S., and 25% below those of Brazil, Latin America’s largest economy.

“Many companies are beginning to see the world in a new light,” said Harold L. Sirkin, a BCG senior partner and co-author of the report. “They are finding that many old perceptions of low-cost and high-cost countries are out of date, and they are starting to realign their global sourcing and production networks accordingly.”