For more publications by the Business Research Division of the Leeds School of Business at CU Boulder, click here.

By Brian Lewandowski, Associate Director, Business Research Division, Leeds School of Business

The March jobs report was released for Colorado today, with the preliminary numbers showing a month-over-month decline in employment (-3,900 jobs, -0.2%), and a downward revision to the February estimates. According to data from the Bureau of Labor Statistics, March recorded 67,700 more jobs than the same month in 2013, increasing 2.8% year-over-year. The pace of growth slowed, according to the preliminary March numbers, after growing in excess of 3% for 16 consecutive months. Year-over-year growth in March ranked Colorado 11th nationally, and monthly growth ranked the state 32nd. Average weekly wages increased year over year for the first three quarters of 2014 (4.2%, 2.9%, and 3%, respectively). State per capita personal income increased 3.9% in 2014 to rank 14th nationally, and quarterly personal income rose 5.9% year-over-year in Q4 2014.

Colorado employment grew year-over-year in all of Colorado’s metropolitan statistical areas

(MSAs), while monthly growth decreased in three MSAs. Industry growth was recorded in 10 of the 11 industries in the state year-over-year, but growth was only recorded in four industries month-over-month. The velocity of growth slowed in 8 industries.

The greatest year-over-year percentage gains were in Construction (10.4%), Mining and Logging (8.9%), and Education and Health Services (4.9%). The weakest sectors for growth included Information (-2.3%), Other Services (0.7%), and Professional and Business Services (1%). Compared to February, the strongest growth came from Financial Activities, Government, and Education and Health Services; the weakest being Mining and Logging, Professional and Business Services, and Other Services.

Growth in Colorado’s Manufacturing Sector ranked 3rd nationally, with 3.3% year-over-year

growth, but employment slipped 0.2% from February to March. Employment in the Mining and

Logging sector, which is dominated by oil and gas activity, was up 8.9% year-over-year in

March, but the employment estimates were revised down in February, and continued to lose jobs in March (1.1% month-over-month).

The construction industry increased by the greatest pace and absolute number of jobs year-over- year in Colorado, and home prices increased 9% year-over-year in Q4 2014 according to the FHFA home price index.

While WTI oil spot prices began to fall in June 2014, the economic indicators remained fairly

strong until early 2015, subsequently declining. As of mid-April, the WTI spot price was down

52% from June 20, 2014. Average weekly natural gas (Henry Hub) prices were down 43% year- over-year in mid-April, and gasoline prices down 36%. The falling oil and gas prices have placed a drag on the oil and gas industry nationally and in Colorado. The Baker-Hughes rig count in Colorado was down 42% in April compared to the same period in 2014, and was down 48% nationally. Evidence of the slowing industry also shows in the employment numbers—the Mining and Logging Sector as a whole lost jobs nationally in January, February, and March, down 29,000 jobs from December (-3.2%). Colorado has recorded two consecutive months of Business Research Division Leeds School of Business University of Colorado Boulder modest employment declines in the sector, as has the Greeley MSA. Monthly drilling permits—a metric that tends to be volatile—decreased year-over-year in March. Of the 42 states with published Mining and Logging employment, only 5 states marked monthly employment growth in March, and 12 recorded year-over-year growth.

The March unemployment rate stood at 4.2% for the fourth consecutive month, ranking

Colorado 14th nationally. At the low end, Nebraska and North Dakota are ranked 1st and 2nd, at 2.6% and 3.1%, respectively. At the high end, Nevada and Mississippi were ranked 50th and 49th with 7.1% and 6.8% unemployment, respectively. Year-over-year growth (1%) in the Colorado labor force ranked 28th in percentage terms and 22nd in absolute growth.

Comparing Colorado job growth to other states, Colorado still remains one of the best recovery states in the nation in terms of employment, ranking 4th nationally for growth above the previous peak, behind only North Dakota, Texas, and Utah. Colorado now measures 6% above 2008 peak employment compared to 2% for the nation. National job growth weakened in March, with the United States adding 126,000 jobs compared to 264,000 in February. The three-month moving average ending in March was 197,000, compared to 193,000 a year ago.

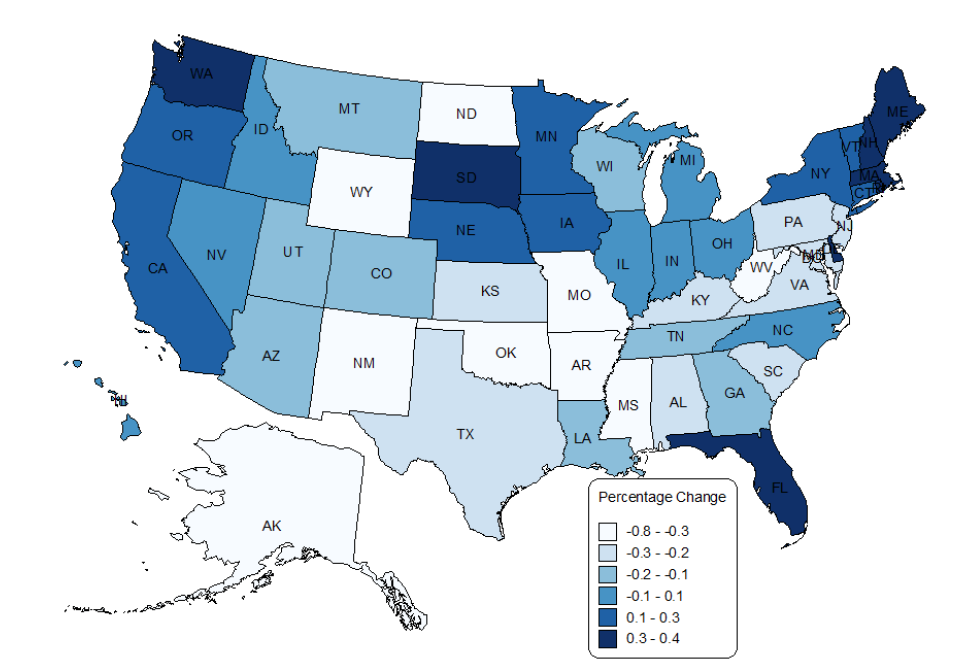

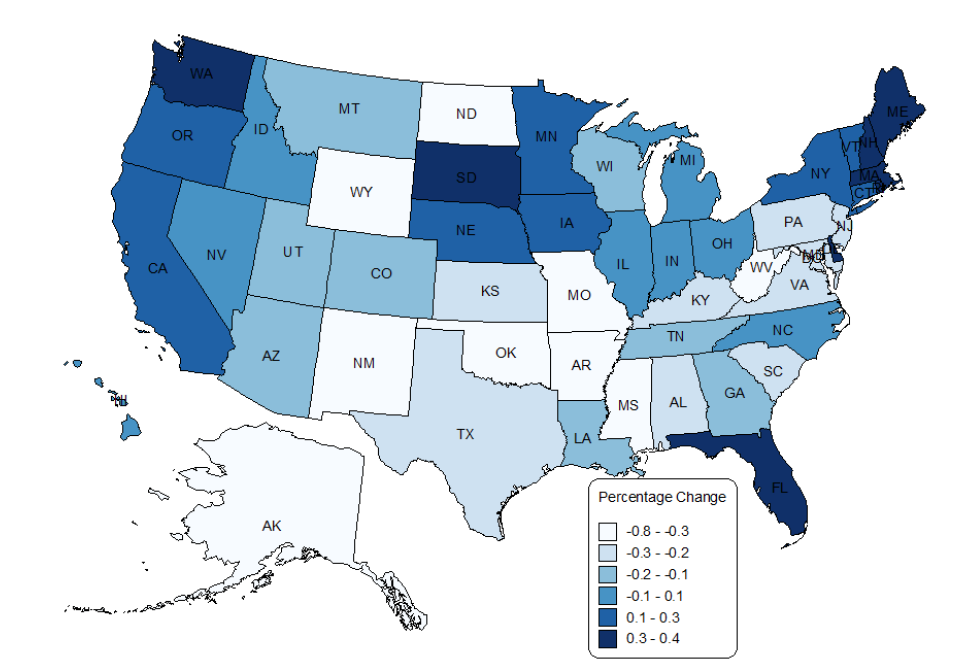

March State Employment Growth, Month-over-Month

Data Source: Bureau of Labor Statistics, CES (Seasonally Adjusted).

Despite growth across the state, wide variations persist, with the year-over-year growth recorded in the Greeley (7.2%), Denver-Aurora-Broomfield (3.6%), Pueblo (2.9%), Fort Collins-Loveland (2.8%), Colorado Springs (2%), Boulder (1.7%), and Grand Junction (1.3%) MSAs. Month-over-month growth was recorded in the Fort Collins (0.5%), Colorado Springs (0.3%), Grand Junction (0.2%), and Boulder (0.1%) MSAs. Month-over-month, employment decreased slightly in the Denver-Aurora-Broomfield (-0.2%), Greeley (-0.5%), and Pueblo (-0.7%) MSAs.

The April national jobs report will be released May 8, 2015. The April state jobs report will be released May 27, 2015.

For more publications by the Business Research Division of the Leeds School of Business at CU Boulder, click here.

Because of the risk, buyers rarely use red clause letters of credit. However, buyers such as the mosaic tile importer, who have to pay cash up-front, may consider the red clause letter of credit as a viable alternative.

Because of the risk, buyers rarely use red clause letters of credit. However, buyers such as the mosaic tile importer, who have to pay cash up-front, may consider the red clause letter of credit as a viable alternative.

Unfortunately, the supplier dispatched the candy one day after the latest date allowed for shipment. When the issuing bank noted this discrepancy, they contacted the applicant for approval to pay, but the applicant declined because the late shipment meant missing the festival date. The Greek bank was notified that payment had been refused.

Unfortunately, the supplier dispatched the candy one day after the latest date allowed for shipment. When the issuing bank noted this discrepancy, they contacted the applicant for approval to pay, but the applicant declined because the late shipment meant missing the festival date. The Greek bank was notified that payment had been refused.